Introduction: The Mysterious World of Deductibles

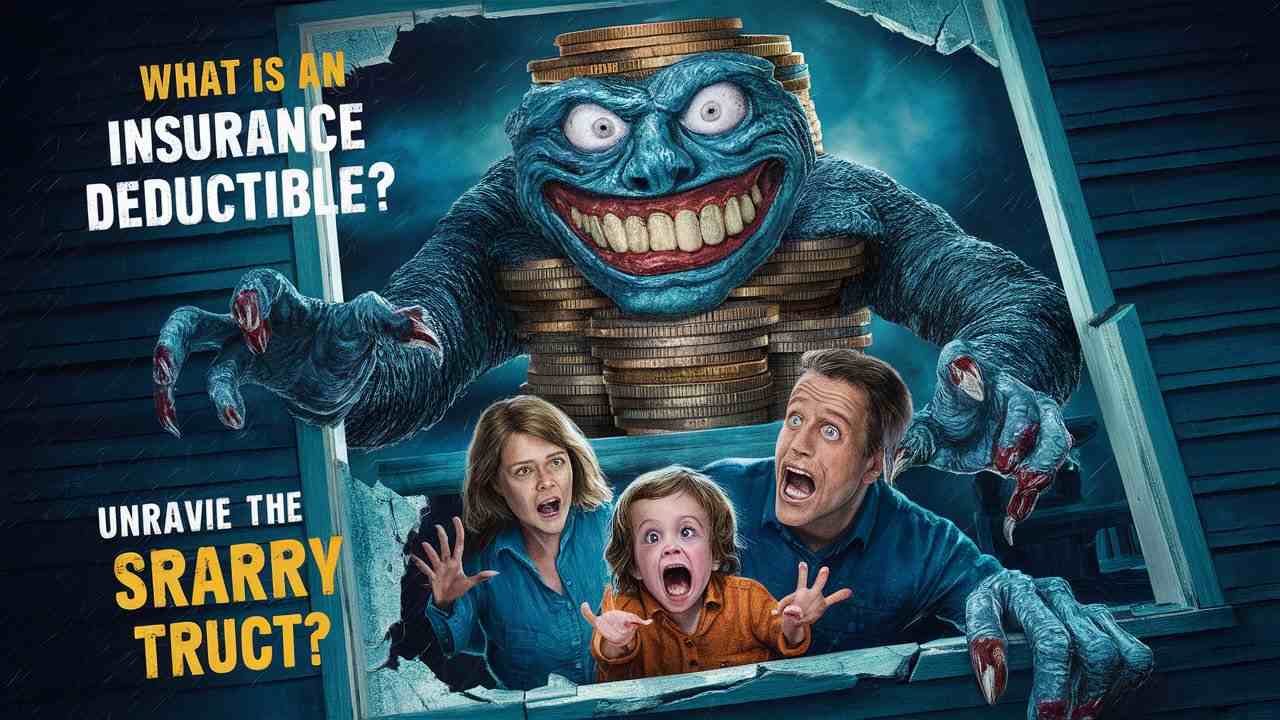

Welcome to the enigmatic realm of insurance deductibles a place where confusion meets your wallet. Think of deductibles as the eerie goblins lurking in the shadows of your insurance policy. They’re often misunderstood and can feel as scary as a haunted house on a dark, stormy night. Let’s shine a light on these elusive creatures and help you navigate through their spooky mysteries.

What Exactly is an Insurance Deductible?

An insurance deductible is the amount of money you must pay out-of-pocket before your insurance kicks in to cover the rest. Imagine it as a financial “entry fee” to your insurance party. For instance, if you have a $500 deductible on your health insurance and rack up $1,000 in medical bills, you’ll pay the first $500 yourself, and your insurer will cover the remaining $500. It’s like the insurance company’s way of saying, “Welcome aboard, but you’ve got to contribute to the party!”

How Deductibles Fit Into Your Insurance Policy

Deductibles play a crucial role in shaping the cost and coverage of your insurance policy. They serve as a cost-sharing mechanism between you and your insurer. The higher the deductible, the lower your monthly premiums may be, and vice versa. Think of it as a balancing act on a tightrope your deductible and premium must find equilibrium. The deductible determines how much you need to shell out before your insurance provider starts footing the bill.

Types of Deductibles: From Health to Auto

Deductibles come in various flavors, each tailored to different types of insurance. Health insurance, auto insurance, home insurance they all have their own unique twist on deductibles. It’s like choosing between a ghost story, a zombie flick, or a supernatural thriller. Each type of deductible serves a different purpose but operates on the same basic principle: you pay a certain amount before your insurance starts covering costs.

The Haunted House of Health Insurance Deductibles

Navigating health insurance deductibles can feel like wandering through a haunted mansion. The terminology alone copayments, coinsurance, out-of-pocket limits can be enough to make your head spin. Health insurance deductibles often vary based on the plan type and whether you receive care from in-network or out-of-network providers. It’s essential to understand how these deductibles work to avoid any unwelcome surprises lurking in your medical bills.

Understanding Health Insurance Deductibles: The Basics

In health insurance, the deductible is the amount you must pay before your insurance company starts covering your medical expenses. The basics are relatively straightforward: if you have a $1,000 deductible, you’ll need to pay the first $1,000 of your medical bills yourself. After that, your insurance will cover costs according to the terms of your plan. Some plans might also include a coinsurance rate, where you share a percentage of the costs after meeting your deductible.

High Deductible Health Plans vs. Low Deductible Plans

High deductible health plans (HDHPs) might sound ominous, but they come with lower monthly premiums, making them an attractive option for those who don’t anticipate frequent medical visits. Conversely, low deductible plans offer higher monthly premiums but lower out-of-pocket costs when you need care. The choice between high and low deductible plans is a bit like deciding between a thrilling roller coaster and a gentle carousel ride both have their pros and cons depending on your preferences and needs.

The Dreaded Out-of-Pocket Maximum: What’s That About?

The out-of-pocket maximum is the cap on how much you’ll spend in a given year before your insurance covers 100% of your medical expenses. It’s like the safety net at the bottom of a high dive. Once you hit this limit, your insurer picks up the entire tab. While it might seem like a distant dream when you’re dealing with high medical costs, it provides a crucial safety net to protect you from catastrophic expenses.

Auto Insurance Deductibles: More Than Just a Scratch

Auto insurance deductibles are like the speed bumps of car insurance. They come into play when you file a claim for damage to your vehicle. Whether it’s a minor fender-bender or a major collision, your deductible is the amount you’ll need to pay before your insurance covers the rest. The type of coverage you have collision or comprehensive can affect how and when your deductible applies.

Collision vs. Comprehensive Deductibles: What’s the Difference?

Collision deductibles apply to damage from accidents involving another vehicle or object, while comprehensive deductibles cover non-collision events such as theft, vandalism, or natural disasters. It’s like comparing a haunted house to a zombie apocalypse both are scary, but they’re triggered by different kinds of mayhem. Understanding the distinction can help you better navigate your insurance coverage and manage your out-of-pocket costs.

How to Handle Your Auto Insurance Deductible After an Accident

After an accident, dealing with your auto insurance deductible involves a few key steps. First, report the accident to your insurer and get an estimate for repairs. Pay your deductible amount directly to the repair shop, and your insurance will cover the remaining costs. If the accident was someone else’s fault, you might be able to recover your deductible through their insurance. Navigating this process can feel like solving a mystery, but staying organized and proactive can help you manage the situation effectively.

Home Insurance Deductibles: Protecting Your Castle

Home insurance deductibles are designed to protect your abode from various perils, such as fire, theft, or natural disasters. They work similarly to auto insurance deductibles pay the deductible amount first, and your insurance will cover the rest. The amount of your deductible can impact your premium and overall coverage, so it’s essential to choose a deductible that balances your financial situation with your protection needs.

Understanding Home Insurance Deductibles: A Deep Dive

A deep dive into home insurance deductibles reveals how they function in protecting your property. Higher deductibles often lead to lower premiums, but you’ll need to pay more out-of-pocket if a claim arises. Conversely, lower deductibles mean higher premiums but less financial strain when making a claim. It’s a balancing act, akin to managing a complex chess game, where strategic choices determine your long-term financial stability.

Natural Disasters and Deductibles: When Mother Nature Strikes

When natural disasters like hurricanes, earthquakes, or wildfires strike, deductibles can significantly impact your insurance claim. Some home insurance policies have separate deductibles for specific disasters, which can be considerably higher than your standard deductible. Understanding these disaster-specific deductibles is crucial for financial preparedness and ensuring you’re not caught off guard when nature unleashes its fury.

The Creepy Crawly Details of Renters Insurance Deductibles

Renters insurance deductibles are often less intimidating than those of home or auto insurance but still play a vital role. They cover damage to your personal belongings caused by events such as theft, fire, or vandalism. While renters insurance deductibles are generally lower, they still require you to pay a portion of the claim before your insurer covers the rest. Knowing these details can help you make informed decisions about your renters insurance policy.

Life Insurance and Deductibles: Do They Even Exist?

Unlike other types of insurance, life insurance typically doesn’t have a deductible. Instead, you pay premiums to keep your policy active. In the unfortunate event of a claim, your beneficiaries receive the death benefit without needing to pay a deductible. It’s a different beast altogether, focusing on providing financial support rather than managing costs through deductibles.

The Gory Truth About Deductibles and Your Premiums

Deductibles and premiums are intricately linked. Generally, higher deductibles lead to lower premiums, while lower deductibles result in higher premiums. This relationship is a bit like a financial tug-of-war balancing your deductible with your premium cost can help you find the right equilibrium for your budget and coverage needs.

How Deductibles Impact Your Premium Costs

Your deductible has a direct impact on your premium costs. Opting for a higher deductible usually means you’ll pay less in monthly premiums but will need to cover more out-of-pocket if a claim arises. On the flip side, a lower deductible often results in higher premiums but less financial strain when filing a claim. Understanding this impact helps you make strategic decisions about your insurance coverage.

Should You Opt for a Higher or Lower Deductible?

Choosing between a higher or lower deductible involves assessing your financial situation and risk tolerance. A higher deductible can save you money on premiums, but it means more out-of-pocket expenses if you need to make a claim. A lower deductible offers less financial strain at the time of a claim but comes with higher monthly premiums. Weighing these options carefully can help you tailor your insurance to your financial goals.

The Fear Factor: Can Deductibles Affect Your Claims?

Deductibles can certainly affect your claims experience. If you choose a high deductible, you may find yourself paying a significant amount out-of-pocket before your insurance kicks in. This can lead to financial stress if you’re not prepared. On the other hand, lower deductibles mean less financial burden during a claim but higher monthly costs. Understanding how deductibles impact your claims helps you make informed decisions about your insurance coverage.

Real-Life Scenarios: When Deductibles Become a Nightmare

Real-life scenarios often highlight the challenges of dealing with deductibles. Imagine having to cover a large deductible after a major car accident or a home disaster. These situations can turn your worst fears into reality, showcasing the importance of selecting a deductible that aligns with your financial capacity and risk tolerance.

Tips for Managing and Minimizing Your Deductible Costs

Managing and minimizing deductible costs involves strategic planning. Consider building an emergency fund to cover potential deductibles, opting for higher deductibles if you can afford the out-of-pocket costs, or exploring insurance options with lower deductibles if budget constraints are

a concern. Staying proactive and informed can help you navigate the deductible landscape more effectively.

Choosing the Right Deductible: A Strategic Approach

Choosing the right deductible requires a strategic approach. Evaluate your financial situation, risk tolerance, and insurance needs to find a deductible that balances your premium costs with your out-of-pocket expenses. Consulting with an insurance advisor can also provide valuable insights to help you make an informed decision.

Conclusion

Conquering the Deductible Monster with Confidence

Navigating the world of insurance deductibles doesn’t have to be a spine-chilling experience. By understanding how deductibles work and how they impact your insurance coverage and costs, you can tackle this financial beast with confidence. Armed with knowledge, you’ll be better prepared to make decisions that align with your needs and financial goals, turning the scary deductible monster into a manageable aspect of your insurance strategy.

Frequently Asked Questions (FAQs)

What is comprehensive coverage?

Comprehensive coverage is a type of car insurance that protects against damages to your vehicle not caused by a collision. This includes incidents such as theft, vandalism, natural disasters, and animal strikes. It helps you avoid the financial burden of repairing or replacing your vehicle in these unfortunate situations.

How can insurance protect you from financial loss?

Insurance protects you from financial loss by covering costs associated with unexpected events. Whether it’s medical bills, property damage, or legal fees, insurance provides financial support based on the terms of your policy. By paying regular premiums, you mitigate the risk of bearing substantial out-of-pocket expenses during crises.

What is the collision insurance?

Collision insurance covers damage to your vehicle resulting from a collision, regardless of who is at fault. This means if you hit another vehicle or object, or if you’re involved in a rollover accident, collision insurance helps pay for repairs or replacement of your car, minus your deductible.

Do I have to pay my deductible if someone hits me in Michigan?

In Michigan, if someone else hits you, you generally don’t have to pay your deductible if the at-fault party’s insurance covers the damages. However, if you make a claim through your own insurance, you might need to pay the deductible, which could later be reimbursed if the other party is found liable.

What happens if I’m at fault in a car accident in California?

If you’re at fault in a car accident in California, your insurance will cover the damages to the other party’s vehicle and property, depending on your policy limits. You will also be responsible for paying your deductible, and your insurance premiums may increase as a result of the claim.

What happens if you get insurance after an accident in California?

If you get insurance after an accident in California, your newly purchased policy typically won’t cover the accident that occurred before the policy’s effective date. Insurance policies generally only cover incidents that occur after the policy starts, leaving you responsible for the costs of any accidents that happened beforehand.

Is it better to have a $500 deductible or $1000?

Choosing between a $500 and $1000 deductible depends on your financial situation and risk tolerance. A lower deductible ($500) means you’ll pay less out-of-pocket when you make a claim but will likely have higher premiums. A higher deductible ($1000) generally results in lower premiums but requires you to pay more if you need to file a claim.

What does $500 deductible mean?

A $500 deductible means you must pay the first $500 of a claim before your insurance coverage kicks in. For example, if you have a $500 deductible and incur $2000 in damages, you’ll pay $500, and your insurance will cover the remaining $1500.

Is comprehensive the same as deductible?

No, comprehensive and deductible are not the same. Comprehensive coverage refers to protection against non-collision-related damages to your vehicle. A deductible is the amount you pay out-of-pocket before your insurance starts covering costs, applicable to both comprehensive and collision coverage.

Do I really need fully comprehensive car insurance?

Whether you need fully comprehensive car insurance depends on your vehicle’s value, your financial situation, and your personal preferences. Comprehensive insurance offers extensive protection against a variety of risks beyond just collisions, which can be beneficial if you want to avoid potential financial losses.

What is a deductible in insurance?

A deductible in insurance is the amount you must pay out-of-pocket before your insurance company begins to cover the remaining costs of a claim. It’s a financial threshold that helps share the risk between you and the insurer.

Should I pay the deductible if not at fault?

If you’re not at fault in an accident, you might still need to pay the deductible initially if you file a claim with your own insurance. However, you can often seek reimbursement from the at-fault party’s insurance or through legal action if necessary.

What does $2000 deductible mean?

A $2000 deductible means you must pay the first $2000 of your claim before your insurance company starts covering the remaining expenses. If your total claim amount is $3000, you will pay $2000, and your insurer will cover the remaining $1000.

Who is the insurance premium paid by?

The insurance premium is paid by the policyholder, the individual or entity who holds the insurance policy. Premiums are typically paid on a regular basis (monthly, quarterly, or annually) to maintain the coverage and ensure the insurer remains obligated to provide protection.

What is the deductible reimbursement policy?

The deductible reimbursement policy is a feature that may be offered by some insurance companies, where they cover your deductible amount after a claim if the other party is found to be at fault. This policy helps alleviate the financial burden of paying the deductible out-of-pocket while waiting for reimbursement.

Hashtags:

InsuranceDeductible #Insurance101 #CoveredCosts #DeductibleSavings #InsuranceTips #PolicyKnowledge #SmartInsurance #DeductibleAdvice #InsuranceGuide #FinancialPlanning