Ah, loan payments. The unavoidable part of adulting that’s right up there with doing taxes and pretending to enjoy kale smoothies. But fear not, brave reader, for you are about to embark on a journey to demystify this financial enigma. Grab a cup of coffee (or something stronger), and let’s dive into the wonderful world of loan payments!

Why You Need to Master Loan Calculations

Mastering loan calculations isn’t just a skill for the mathletes among us. It’s crucial for anyone who wants to avoid the trap of financial ignorance. Understanding how to calculate loan payments empowers you to make informed decisions, avoid unnecessary costs, and ultimately keep more of your hard-earned money in your pocket. Plus, it’s a great way to impress your friends at parties. Trust me, they’ll be fascinated.

Understanding the Basics

What Exactly is a Loan Payment?

At its core, a loan payment is a sum of money you repay to a lender over a specified period. This payment is typically made monthly and includes both the principal (the amount you borrowed) and the interest (the lender’s fee for letting you borrow their money). Think of it as renting money, but instead of returning the exact amount, you give back a bit more for the privilege.

The Key Components: Principal, Interest, and Term

Let’s break down the jargon. The principal is the original amount you borrow. The interest is the cost of borrowing that money, expressed as a percentage. The term is the length of time you have to repay the loan. Simple, right? Yet, these three components interact in ways that can make your head spin faster than a Tilt-A-Whirl at the county fair.

Types of Loans

Mortgages, Auto Loans, and Personal Loans, Oh My!

Not all loans are created equal. Mortgages help you buy a home, auto loans get you behind the wheel of a car, and personal loans are the versatile, jack-of-all-trades financial tools you can use for almost anything. Each type comes with its own set of rules, interest rates, and repayment terms. Navigating through these options can feel like wandering through a financial jungle, but with the right map, you’ll find your way.

Fixed vs. Variable Interest Rates: What’s the Difference?

Fixed interest rates remain constant throughout the life of the loan, providing predictability and peace of mind. Variable rates, on the other hand, fluctuate with the market, which can either be a boon or a bane depending on the economic climate. It’s a bit like choosing between a stable, albeit boring, partner and a wild, unpredictable romance. Both have their perks and pitfalls.

The Magic of Interest Rates

How Interest Rates Impact Your Loan Payments

Interest rates are the secret sauce of loan payments. A high interest rate means you’ll pay more over the life of the loan, while a low rate saves you money. Even a small difference in rates can significantly impact your monthly payments and the total cost of the loan. It’s like the difference between a drizzle of dressing and drowning your salad—every little bit counts.

APR vs. Interest Rate: Spot the Difference

APR (Annual Percentage Rate) includes not just the interest rate but also any additional fees or costs associated with the loan. It gives a more accurate picture of what you’re actually paying. If the interest rate is the headline act, consider the APR the full concert experience, complete with hidden fees and surprise performances.

Getting Down to the Numbers

The Simple Loan Payment Formula Explained

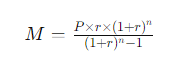

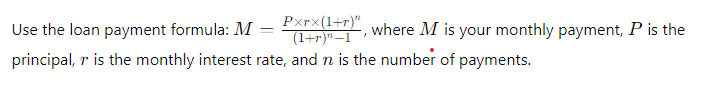

The basic loan payment formula might look like hieroglyphics, but it’s simpler than it seems. The formula is:

where:

- MMM is your monthly payment

- PPP is the principal

- rrr is the monthly interest rate

- nnn is the number of payments

Break out your calculator and give it a go. It’s surprisingly satisfying to see the numbers fall into place.

**Compound Interest: Friend or Foe?

Compound interest can be your best friend or your worst enemy. When it’s working for you (say, in a savings account), it’s fantastic. But when it’s working against you (on a loan), it can lead to paying significantly more over time. Understanding compound interest is like having a secret weapon in your financial arsenal.

The Monthly Payment Breakdown

Principal vs. Interest: Who Gets Paid First?

In the early stages of a loan, a larger portion of your payment goes towards paying off the interest. Over time, more of your payment goes towards reducing the principal. It’s a bit like a financial see-saw, with the balance shifting gradually in your favor.

How Loan Term Affects Your Monthly Payment

The term of your loan has a major impact on your monthly payments. A longer term means lower monthly payments but more interest paid over the life of the loan. Conversely, a shorter term means higher monthly payments but less interest overall. It’s a delicate balance, much like choosing between binge-watching your favorite show and getting a good night’s sleep.

The Hidden Costs of Loans

Watch Out for Those Sneaky Fees!

Lenders love their fees. Origination fees, late payment fees, prepayment penalties—the list goes on. These sneaky charges can add up quickly, so it’s crucial to read the fine print. Think of it as looking under the bed for monsters before you sign on the dotted line.

Insurance and Taxes: The Extras You Can’t Ignore

Insurance and taxes can also inflate your loan costs. Mortgage loans often require homeowners insurance and property taxes, while auto loans might necessitate full coverage insurance. These extras are like the annoying but necessary accessories that come with buying something new—they’re not optional, and they’re not cheap.

Loan Calculators: Your New Best Friend

How to Use Online Loan Calculators

Online loan calculators are a godsend. Input your loan amount, interest rate, and term, and voila! You get an instant breakdown of your monthly payments and total costs. They’re like having a financial advisor in your pocket, minus the hefty consulting fee.

Best Free Loan Calculator Tools Out There

There are plenty of great free loan calculators available online. Sites like Bankrate, NerdWallet, and even Google offer reliable tools to help you crunch the numbers. They’re user-friendly and take the guesswork out of loan calculations.

DIY Calculation Methods

Breaking Out the Calculator: Step-by-Step Guide

If you’re a DIY enthusiast, calculating loan payments manually can be a rewarding challenge. Follow the loan payment formula step-by-step, double-check your numbers, and feel the thrill of accomplishment when you get it right. It’s like solving a financial puzzle.

Excel Magic: Formulas for Loan Payments

Excel isn’t just for spreadsheets. It’s a powerful tool for calculating loan payments. Use formulas like PMT, IPMT, and PPMT to break down your payments and visualize your repayment schedule. It’s financial wizardry at your fingertips.

Common Mistakes to Avoid

The Top Blunders People Make Calculating Loans

Mistakes happen, but some are more costly than others. Common errors include overlooking fees, miscalculating interest rates, and underestimating the impact of loan term changes. Avoid these pitfalls and save yourself from financial headaches.

How to Double-Check Your Math and Sleep Easy

Double-checking your calculations is essential. Use multiple sources, compare results, and don’t be afraid to ask for help. Ensuring your numbers are correct will help you sleep easy, knowing you’ve got a handle on your finances.

Refinancing: The Game Changer

When and Why to Consider Refinancing

Refinancing can be a game-changer, offering lower interest rates, reduced monthly payments, or shorter loan terms. Consider refinancing when interest rates drop, your credit score improves, or you want to tap into your home’s equity. It’s like hitting the reset button on your loan.

How to Calculate the Costs and Savings of Refinancing

To determine if refinancing is worth it, calculate the total costs (including closing fees) and compare them to the savings from the new loan terms. It’s a bit of a balancing act, but with the right approach, you can come out ahead.

Loan Payment Strategies

Bi-Weekly Payments: Faster Payoff, Less Interest

Switching to bi-weekly payments can help you pay off your loan faster and reduce the total interest paid. By making half-payments every two weeks, you end up making an extra payment each year. It’s a sneaky yet effective strategy.

The Snowball vs. Avalanche Methods: Which is Right for You?

The Snowball method involves paying off your smallest debts first, while the Avalanche method focuses on the highest interest debts. Both have their merits, so choose the one that best suits your financial temperament and goals.

Planning for the Future

How to Factor Loan Payments into Your Budget

Incorporating loan payments into your budget is crucial for financial stability. Track your income, expenses, and savings to ensure you can comfortably meet your loan obligations. Budgeting is the financial equivalent of building a sturdy foundation.

Building an Emergency Fund to Cover Loan Payments

An emergency fund is your financial safety net. Aim to save three to six months’ worth of expenses to cover unexpected events. It’s like having a financial cushion to soften any blows that life might throw your way.

BOTTOM LINE

Recap: You’re Now a Loan Payment Calculation Pro!

Congratulations! You’ve journeyed through the intricate world of loan payments and emerged wiser and more confident. You now possess the knowledge to calculate loan payments, understand the costs, and make informed decisions.

Ready, Set, Calculate: Taking Control of Your Financial Future

Armed with your newfound expertise, you’re ready to take control of your financial future. Whether you’re taking out a new loan or managing existing ones, you’ve got the tools to succeed.

Call to Action

Share Your Loan Payment Success Stories!

Have a loan payment success story? Share it with us! Your experience could inspire and help others navigate their financial journeys.

Subscribe for More Tips and Tricks on Financial Mastery

Want more tips and tricks on mastering your finances? Subscribe to our blog for regular updates and insights. Join our community of financial whizzes today!

Frequently Asked Questions (FAQs)

What is the difference between APR and interest rate?

APR includes the interest rate plus any additional fees or costs associated with the loan, providing a more comprehensive view of the total cost of borrowing.

How can I calculate my loan payments manually?

What are the benefits of bi-weekly loan payments?

Bi-weekly payments can help you pay off your loan faster and reduce the total interest paid, as you end up making an extra payment each year.

When should I consider refinancing my loan?

Consider refinancing when interest rates drop, your credit score improves, or you want to tap into your home’s equity to get better loan terms or lower monthly payments.

What are common mistakes to avoid when calculating loan payments?

Common mistakes include overlooking fees, miscalculating interest rates, and underestimating the impact of loan term changes. Double-check your calculations to avoid these pitfalls.