Navigating the world of checks can feel as perplexing as deciphering ancient hieroglyphics. But fear not! The act of cashing a check is simpler than it seems, and with a little knowledge, you can turn that piece of paper into actual cash faster than you can say “financial literacy.”

What Is a Check and How Does It Work?

At its core, a check is a written order directing a bank to pay a specified amount from the drawer’s account to the payee. Think of it as an IOU written on a fancy piece of paper. The moment you decide to cash a check, you’re effectively turning that promise into cold hard cash. Once you present the check to your bank or another cashing entity, they verify its validity and the funds are released. It’s like a magic trick🤑except instead of rabbits, you’re pulling out cash!

Types of Checks: Personal, Payroll, and More

Checks come in various flavors, each with its own unique properties. Personal checks are the most common, typically written by individuals. Payroll checks, on the other hand, are like gold🤑given to you by your employer as a reward for your hard work. And let’s not forget cashier’s checks, which are issued by banks and guarantee funds. Understanding these types is crucial, as some places may treat them differently when it comes to cash checking.

Why Cashing a Check Can Feel Like a Game of Monopoly

Ever played Monopoly? You might remember the thrill of collecting those colorful bills and the occasional “Go to Jail” card that could ruin your day. Cashing a check can sometimes feel like this. From understanding bank policies to avoiding fees, it’s a game of strategy. But don’t worry🤑this guide will help you navigate the board with ease.

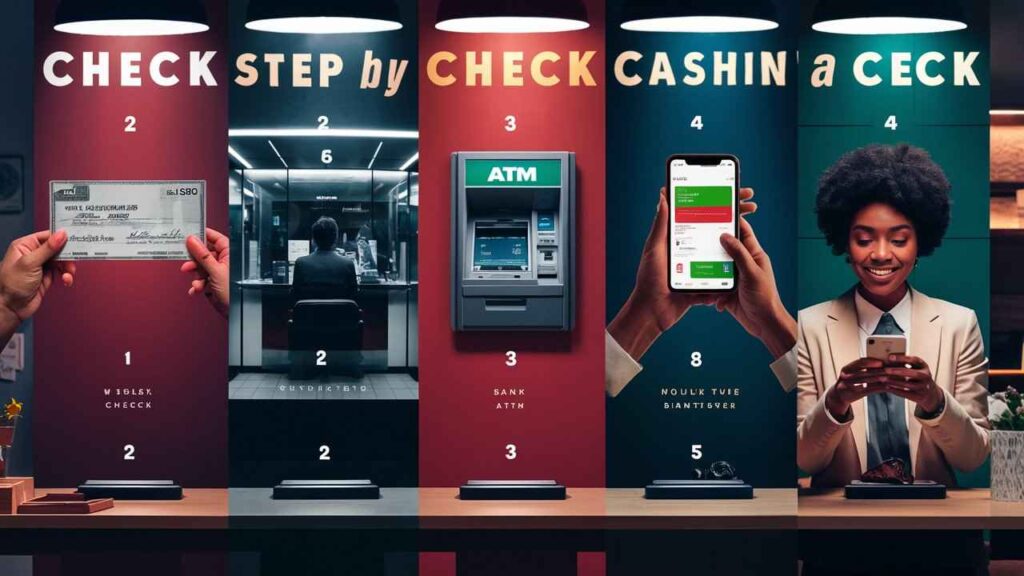

Step 1: Choose Your Cashing Method

Now that you understand the basics, it’s time to pick your cashing method. Your options range from traditional banks to modern digital solutions.🤑

Banks: The Traditional Route to Cashing Checks

When in doubt, banks are the tried-and-true method for cash checking. Most banks will cash checks for account holders without issue. However, they may charge a fee for non-account holders, and you might face longer wait times.

Credit Unions: Your Friendly Neighborhood Option

Credit unions often provide more personalized service than banks. If you’re a member, cashing a check is usually a breeze. They often boast lower fees and quicker service🤑so don’t forget to check your local credit union!

Check-Cashing Services: Convenience with a Price Tag

Check-cashing services are the fast food of the cashing world. They’re everywhere, often open late, and quick to serve you. However, convenience comes at a price, as their fees can be steep. If you need cash now and can’t wait, they might be your best bet.

Retail Stores: Can You Really Cash a Check at the Grocery Store?

Surprisingly, many grocery stores and retail chains like Walmart offer check-cashing services. Yes, you can grab some milk and cash your paycheck in one fell swoop. However, keep in mind the limits and fees involved, which can vary from store to store.🤑

Step 2: Gather Your Required Documents

Before you embark on your check-cashing adventure, make sure you’re armed with the right documents.

Identification: What Do You Need to Bring?

Most establishments require a valid form of ID. This could be your driver’s license, passport, or another government-issued identification. Just remember, a library card won’t cut it here.🤑

The Check Itself: Don’t Leave Home Without It!

This one seems obvious, but you’d be surprised how often people forget the check they intend to cash! Double-check your pockets and bag to ensure it’s there before you head out.

Proof of Address: Because You Don’t Live in a Van Down by the River

Some locations might ask for proof of address, like a utility bill or lease agreement. This is just to confirm you are who you say you are🤑nothing personal, just business!

Step 3: Know the Fees and Limits

Before you cash in, it’s essential to understand the financial landscape.

Understanding Check-Cashing Fees: A Necessary Evil

Fees for cashing a check can vary widely based on the cashing location and the amount of the check. These fees can range from a few dollars to a hefty percentage of the check. Always ask upfront to avoid any unpleasant surprises.

Daily Cashing Limits: Don’t Get Too Greedy!

Many banks and check-cashing services impose daily cashing limits. This means you may not be able to walk away with that grand total all at once. Check with the provider to know your limits and avoid disappointment.🤑

Are There Alternatives to Avoiding Fees?

If you’re looking to sidestep fees, consider depositing the check into a bank account instead of cashing it. This might take longer but can save you money in the long run.

Step 4: Head to Your Chosen Cashing Location

Now that you’ve done your homework, it’s time to hit the road.

Planning Your Trip: Timing Is Everything

Plan your visit during peak hours. Avoid lunch breaks and weekends if you can. These are the busiest times, and nobody wants to wait in line longer than necessary.

Parking and Safety: Avoiding the ‘Check Cashing Run’ Shuffle

Make sure to park safely and securely. Always be aware of your surroundings when handling cash, and if you’re going to a check-cashing service, bring a friend along if possible. Safety first!

Step 5: Cashing the Check Like a Pro

You’ve made it to the location. Now, let’s do this!🤑

Presenting Your Check: How to Avoid Awkward Moments

When presenting your check, do it confidently! Hand it over along with your ID, and remember to smile🤑this isn’t a funeral, after all.

Waiting in Line: The Art of Patience (and Distraction)

Waiting can be a drag, but you can master it! Bring a book or listen to a podcast. Distracting yourself makes the time fly by, and before you know it, you’ll be at the counter.🤑

Receiving Your Cash: Don’t Forget to Smile!

Once your check is cashed, receive your money with enthusiasm! A simple smile can brighten your day and the day of the cashier. After all, everyone appreciates a little positivity.

Common Mistakes to Avoid While Cashing a Check

While cashing a check is generally straightforward, there are pitfalls to avoid. Don’t forget your ID or check! Always read the terms and conditions, especially concerning fees.

What Happens If Your Check Bounces?

If your check bounces, it’s like opening a can of worms. You may incur fees from both your bank and the issuing bank. Stay informed about your account balance and ensure you cash checks from reliable sources.

When to Seek Help: Customer Service and What to Expect

If you run into problems, don’t hesitate to ask for help. Customer service representatives are there to assist you. Be polite and patient; it’s usually not their fault!🤑

Conclusion: Stress-Free Check Cashing Is Within Reach

Cashing a check doesn’t have to be an anxiety-inducing ordeal. Follow these steps and make the process smooth and hassle-free.

Recap of the 5 Steps to Cash a Check

- Choose your cashing method wisely.

- Gather the necessary documents.

- Know the fees and limits.

- Plan your trip carefully.

- Cash that check like a pro!

Final Thoughts: Celebrate with a Cup of Coffee (or Ice Cream)!

Once you’ve successfully cashed a check, treat yourself! A cup of coffee or a scoop of ice cream is the perfect way to celebrate your newfound cash. After all, you’ve earned it!

People Also Ask

Can someone steal my check?

Yes, checks can be stolen, just like any other form of payment. If someone obtains your check, they can potentially alter it or cash it fraudulently. To mitigate this risk, keep your checks in a secure place and consider using checks with security features, such as watermarks.

How do I deposit a check?

To deposit a check, you can visit a bank branch or an ATM. If using a bank, simply hand the check to the teller along with your identification. If you’re using an ATM, follow the machine’s prompts, which typically involve inserting your card, selecting the deposit option, and inserting the check into the designated slot.

Can I deposit a check at an ATM?

Yes, many ATMs allow you to deposit checks. You’ll need your bank card and the check itself. Just ensure that the ATM is equipped for check deposits, as some machines may only accept cash.

Can I deposit a cheque in any bank?

Generally, you can deposit a check at any bank that is a member of the network your bank uses. However, if it’s a check from a different bank, you may face additional fees or a longer hold on the funds. It’s best to deposit it at the bank that issued the check whenever possible.

How do you write a check for cash?

To write a check for cash, simply fill out the check as you normally would, but in the “Pay to the Order of” line, write “Cash.” This allows anyone who presents the check to cash it. However, it’s advisable to avoid this practice for safety reasons, as anyone can cash it if it’s lost or stolen.

How does cash checking work?

Cash checking is the process of converting a check into cash. This can be done at banks, credit unions, check-cashing services, or retail stores. The entity cashing the check verifies its authenticity and ensures the funds are available before handing over cash.

Is money in checking safe?

Money in a checking account is generally considered safe, especially if your bank is FDIC-insured, meaning your deposits are protected up to a certain limit. However, like any financial service, it’s wise to be vigilant against fraud and regularly monitor your account.

Is cheque a bank money?

A check is not considered “bank money” in the traditional sense. Instead, it is a written order instructing a bank to pay a specific amount from the check writer’s account to the designated recipient. Once cashed, it becomes a transaction involving bank funds.

How do checks work?

Checks work as a form of payment that directs a bank to transfer funds from the check writer’s account to the payee’s account. The process involves the check being presented for payment, verified, and then processed by the bank.

Is checking a debit?

Yes, checking accounts are often linked to debit cards, allowing you to access funds directly. When you use a debit card, you’re spending the money that’s available in your checking account, similar to how you would use cash.

How does the bank verify a check?

Banks verify checks by checking the account number, the signature, and whether the funds are available in the drawer’s account. They also look for any signs of alteration or fraud before cashing or depositing the check.

Can I cash a 20,000 dollar check?

Yes, you can cash a $20,000 check, provided there are sufficient funds in the drawer’s account. However, be aware that some banks might have limits on the amount of cash they can disburse at once, requiring you to visit during business hours.

Can PayPal cash checks?

Yes, PayPal offers a feature that allows you to cash checks via their app. You simply take a picture of the check and submit it for review. After processing, the funds can be transferred to your PayPal balance.

Can I cash a check that’s not in my name?

Generally, you cannot cash a check made out to someone else unless you have that person’s endorsement. They would need to sign the back of the check, allowing you to cash it. However, policies may vary by bank.

Where can I cash a $20 thousand dollar check?

You can cash a $20,000 check at your bank, credit union, or specialized check-cashing service. Be sure to call ahead to confirm they can handle such a large transaction.

Can I cash a check at my own bank?

Yes, you can cash a check at your own bank. In fact, it’s usually the easiest and most cost-effective option, as they may not charge you a fee for cashing a check drawn on your own account.

Where is the easiest place to cash a check?

The easiest place to cash a check is typically at your own bank or credit union. Retailers that offer check-cashing services can also be convenient, especially if you need cash outside of bank hours.

What’s a cash cheque?

A cash cheque is a check that is written to “Cash,” allowing anyone who presents it to cash it. This makes it easy for the holder to access funds, but it also carries risks if lost or stolen.

Can I deposit a cash check?

Yes, you can deposit a cash check into your bank account. Once deposited, the funds will be available based on your bank’s policies regarding holds.

Can I cash in a cheque at an ATM?

Most ATMs allow you to cash a check, provided the ATM has check-cashing capabilities. You’ll need your debit or ATM card to complete the transaction.

Can I deposit a cheque at an ATM?

Yes, you can deposit a cheque at an ATM that offers this service. Just follow the on-screen prompts to insert your check correctly.

Can I withdraw $20,000 from a bank?

You can withdraw $20,000 from a bank, but it’s advisable to inform the bank in advance, as they may not have that amount of cash readily available at the branch.

How to get quick cash?

For quick cash, consider cashing a check at your bank or a check-cashing service. You can also withdraw funds from an ATM if you have cash in your account.

Can I cash a cheque online?

Yes, some banks and financial apps allow you to cash a check online by submitting a photo of the check. Always check your bank’s specific process for this.

Can I cash in a check without a bank?

Yes, you can cash a check without a bank at check-cashing services or retail stores that offer this service, though fees may apply.

How to cash a check at a bank?

To cash a check at a bank, present the check along with valid identification to a teller. If it’s your bank, they may process it quickly without additional fees.

How can I cash a cheque instantly?

To cash a cheque instantly, visit a check-cashing service or your bank during open hours. Ensure you have the necessary identification and documents for a smooth transaction.

Can a bank give me a check?

Yes, banks can issue checks for various transactions, including cashier’s checks, which guarantee the funds and are often used for large purchases.